The Gig Economy: A new challenge for policy makers

I. Overview of the Gig Economy

The gig economy offers flexible and attractive new opportunities for income generation while filling a gap in service provision

The gig economy is defined by a labour market that involves temporary, short-term, or freelance work arrangements, often facilitated through online platforms or mobile applications. “Gig workers” or “freelancers” offer services for individual clients or companies, typically on a flexible and short-term basis. The term “gig” was original used by jazz musicians in the 1920s to characterise a single musical performance. Examples of gig jobs today include a rideshare drivers, a food delivery persons, or a graphic designers offering their services on platforms such as Uber, Deliveroo, Upwork, Fiverr, TaskRabbit, or Airbnb. These platforms have transformed the way people connect to exchange on-demand services with individual service providers seeking flexible income.

Driven by factors such as technological advancements, evolving workplace preferences, and a desire for flexibility, the gig economy has been growing exponentially. What was once viewed as an alternative or supplementary form of employment has now transformed into a primary source of income for approximately one third of the US workforce, contributing to reshape global workforce dynamics.

However, governments globally are facing the challenge of regulating the gig economy in ways that foster innovation while ensuring social protection.

While the rise of the gig economy offers numerous benefits such as increased flexibility for workers, better service provision and reduced overheads for businesses, it also brings forth challenges. Gig work has been criticised for income volatility and absence of social safety nets associated with traditional forms of work. Governments worldwide are grappling with creating regulatory frameworks that ensure gig workers have adequate rights and protections without stifling the innovation that has made the gig economy so prevalent.

II. Key questions for policy makers around the gig economy

The gig economy’s rapid evolution has brought forth a new set of questions that need to be addressed

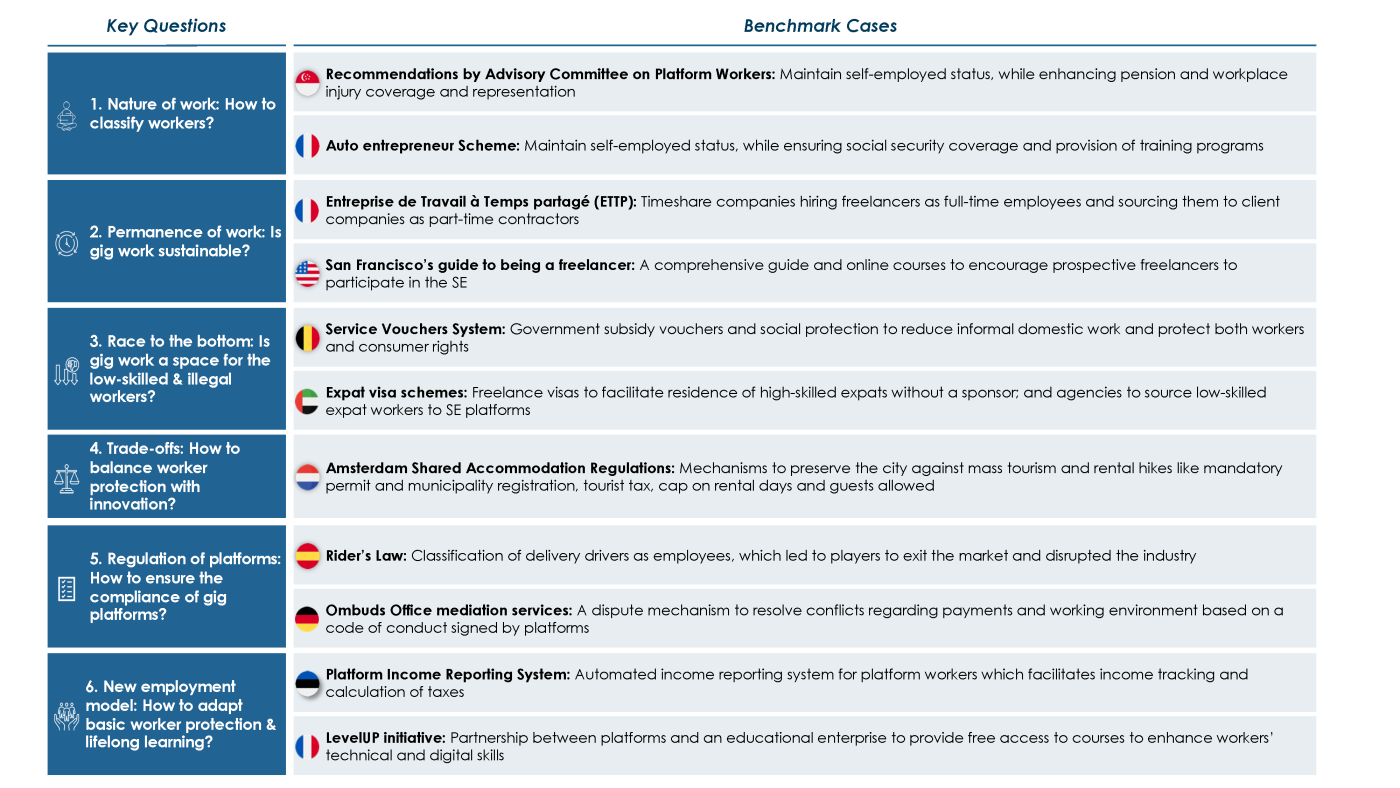

Questions for policy makers around the world revolve around the changing nature of work, the new employment policy model, tradeoffs between innovation and social protection, the regulation of platforms, and the avoidance of race to the bottom.

Figure 1 – The gig economy’s key questions for policy makers

- Nature of Work: Are gig workers employees, entrepreneurs, or service providers?

As the gig economy expands, the very definition of work is being reshaped. Policymakers face the challenge of categorising gig workers accurately: are they independent entrepreneurs, traditional employees with rights, or a new category of service providers altogether? - Permanence of Work: Will gig/freelance work become the new normal?

With a growing proportion of the workforce opting or being nudged into the gig economy, there’s an imperative to determine if this form of employment will become the standard model in the future. - Race to the Bottom: Is the gig and sharing economy work primarily low skill? Does it open space for illegal work?

Concerns arise regarding the skill spectrum of gig jobs. Are they predominantly low-skilled roles, and do they inadvertently create avenues for illicit or underground economic activities? - Trade-offs: How to strike the right balance between protecting gig economy workers and fostering innovation for gig platforms?

The intersection of technological innovation and worker rights presents a dilemma. Policymakers must ensure that regulations safeguard worker interests without stifling the innovative potential of gig platforms. - Regulation of Platforms: How to regulate the gig and sharing economy platforms and ensure their compliance?

With giants like Uber, Airbnb, and DoorDash defining this era, there’s a pressing need to develop regulatory frameworks that not only govern their operations but also ensure they adhere to local and international standards. - New Employment Policy Model: How to adapt basic worker protection related to medical insurance, unemployment insurance, social security, and lifelong learning?

Traditional employment benefits are often misaligned with the realities of gig work. Crafting policies that extend essential protections—like health insurance, unemployment benefits, and opportunities for continuous learning—to gig workers is paramount.

These questions serve as the foundation upon which future gig economy policies must be constructed, taking into account lessons learned from good practices around the world. For example, governments in France and Singapore have been successful in defining a self-employment status for gig workers that maintains work flexibility while ensuring basic social security and training provision. Amsterdam has limited mass tourism and rental price hikes by introducing mandatory permits and city registration, tourist taxes and caps on the number of rental days allowed for online marketplaces that offer homestay experiences such as Airbnb. Spain’s Rider’s law offers lessons on the risks of classifying gig economy workers as regular employees with full labour protection rights: without the labour market flexibility associated with the gig model, food delivery platforms such as Deliveroo exited the market as they were unable to compete.

Gig economy policy experience: Global Responses to Pressing Gig Economy Questions

Understanding how different nations address the challenges of the gig economy can provide invaluable insights. This case box delves into varied global approaches to the pressing questions surrounding the gig economy, highlighting the unique strategies and solutions nations have employed in their quest for balance and progress in this emerging sector.

Sources: Whiteshield, BPI France, Urssaf, Legifrance, Singapore Ministry of Manpower, European Labour Authority, ECONSTAR, SIRAC, Le portail du temps partage, French Ministry of Economy, San Francisco Office of Economic and Workforce Development (OEWD), Aspen Institute, Samaschool, Uber, Careem, Gofreelance, Deliveroo, Airbnb, City of Amsterdam, Ombuds Office, Crowdsourcing Code, Eurofound, Spanish ministry of Inclusion, Social Security and Migration, European Commission, OpenClassrooms.

III. A Comprehensive Policy Framework for the Gig Economy

As the gig economy rapidly evolves, a comprehensive policy framework is essential for policymakers to address its multifaceted challenges and harness its potential.

As we have seen, while promising immense benefits in terms of innovation, work flexibility and service provision, the gig economy also brings forth a host of challenges that call for a comprehensive policy approach. Our proposed policy framework comprises of supply-side, demand-side, and enabling policies (Figure 2).

Figure 2 – The Gig Economy Policy FrameworkTM

1. Supply-Side Policies

These policies are primarily focused on the workers and providers in the gig economy.

- Education and Training: Promote programs that equip gig workers with the necessary skills for the evolving market. For instance, introducing online courses tailored for the gig economy can enhance employability.

- Labour Regulation: This involves providing clarity on worker status, ensuring rights, and guaranteeing safeguards. A notable example is France’s “Auto-entrepreneur” status which provides social protection for gig economy workers.

- Financial Assistance: Establish programs that offer financial support to gig workers, such as low-interest loans or microfinancing.

- Promotion and Awareness: Raise awareness about the benefits and challenges of the gig economy to guide potential workers in making informed decisions.

2. Demand-Side Policies

These target the companies and platforms operating within the gig and sharing economy.

- Business Set-Up: Streamlining investment policies, trade guidelines, and ensuring easier access to finance for emerging gig platforms can foster a nurturing business environment.

- Business Access to Factor Markets: This includes enhancing physical infrastructure, promoting technology adoption, and streamlining human resource processes.

- Business Operation: Regularising business operations, fine-tuning tax policies, ensuring fair competition, and integrating localisation policies can ensure that gig economy businesses function optimally.

3. Enabling Policies

The third pillar focuses on overarching policies that support the broader governance of the gig economy.

- Data Collection: Establish comprehensive methods to gather data on the gig economy’s size, growth, and challenges.

- Monitoring and Evaluation: Implement robust systems to track the efficacy of policies and make necessary adjustments.

- Governance Structures: Develop governance structures that ensure effective oversight and policy consistency to achieve a balance between the protection of gig workers and the growth of gig platforms while addressing the broader societal impacts.

With a gig labour market already accounting for over one third of workers in the United States and growing rapidly in the rest of the world, the gig economy can no longer be ignored. Whiteshield’s Gig Economy Policy FrameworkTM supported by its database of global best practices can help governments steer the gig economy to foster innovation, better quality services and gainful employment for their citizens.

Our experts

Contact us

Subscribe to our newsletter

Subscribe now to receive our latest news